Back in 2014, Perianne Boring wrote an article for Forbes on inflation. It was a good start. In the article, Boring used the change in supply of money as an estimate for inflation. But inflation is not simply the change in quantity of money. It is the change in its value. In order to estimate the change in value, we need to look at demand, in addition to supply.

Unfortunately there is no direct measure for the demand for the dollar, but we can use nominal GDP growth and the M2V to estimate it. The reason we need both is that while it is true that an increase in GDP means that more dollars are needed, because more economic actdivity is occurring, the relationship is not 1:1. The same dollar is used repeatedly. How often it is cycled through in a time period is the velocity of money. This document is in draft and the formulae are still a work in progress.

Formulae

- D is the dollar demand estimate

- P is the GDP value for quarter n

- M is the M2 for the quarter n

- V is the M2V for the quarter n

- I is the quarterly inflation rate

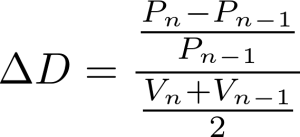

Dollar Demand

Latex: \Delta D = \frac{\frac{P_n – P_{n-1}}{P_{n-1}}}{\frac{V_n+V_{n-1}}{2}}

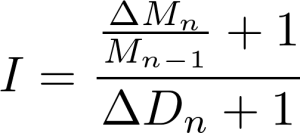

Inflation QoQ

The formula is essentially change in the supply divided by change in the demand.

Latex: I = \frac{\frac{\Delta M_n}{M_{n-1}}+1}{\Delta D_n+1}

Results

Q3-Q4 2016 actually showed rather low inflation, ~2% YoY, which is on par with the official inflation rate. However, for Q4 2015 – Q1 2016, the inflation rate was above 8%! For Q1 – Q2 2016, the rate was ~3.5% and for Q2 – Q3 2016 it was ~3%. This results in an approximate annual inflation rate of 4% (Edited for correction in cell C3 in calculations, which had 2% for some reason originally).

Update

Using MZM rather than M2 gives better overall results. Back testing from 1959, the cumulative inflation through 2016 is estimated at 971% or ~4% annual average inflation between 1959 and 2016. This is a bit higher than the roughly 3.8% average that the BLS gives. However, it is reasonably consistent with price changes according to these price comparisons. On a quarter to quarter basis, the official results and the model are not consistent however. One of the possible sources for the discrepancy is the time lag between when money enters into the economy and when it starts to go into general use. Essentially the real M and V are not quite consistent with official figures.

Notes

- Since the source used weekly and monthly M2, I had to approximate average quarterly M2.

- For back testing, seasonally adjusted figures were used for MZM.

- I might be off by one quarter. I need to shift my indices up by one.

Sources

GDP Quarterly: https://fred.stlouisfed.org/series/GDP

M2 Weekly: http://www.tradingeconomics.com/united-states/money-supply-m2

M2V Quarterly: https://fred.stlouisfed.org/series/M2V

Calculations: https://docs.google.com/spreadsheets/d/1Qqtr_7Mtdo3QUyaWnMT_uJYfpIi69ys5_-WLjrKnpCo/edit?usp=sharing